Reason 5 - Rocket Mortgage Doesn’t Allow You to Escape From Talking to a Mortgage professional. Saving on your interest over the life of your loan will leave you with more money in the bank. Rocket Mortgage could have higher closing costs than local mortgage lenders as well, according to experts.

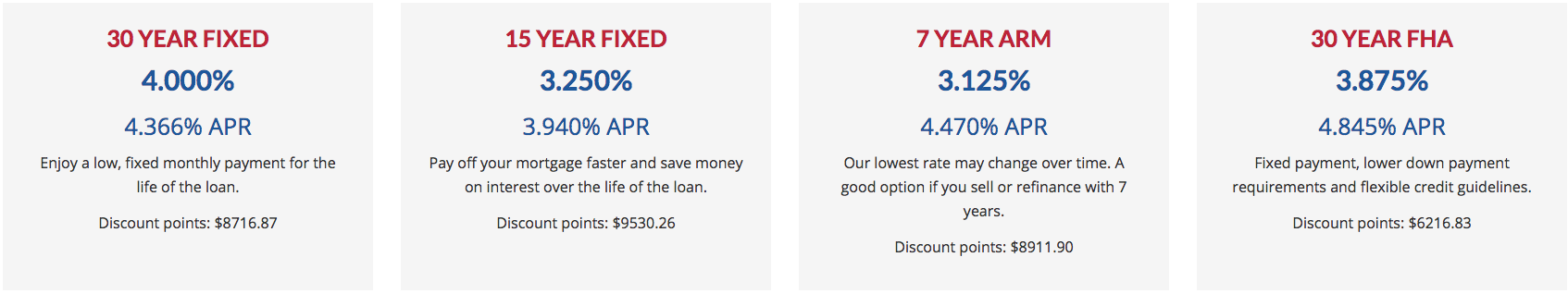

TOP POST: San Diego Housing Bubble? 5 Reasons Why It Won't Crash in 2023 | 2024 Most experts agree it pays to shop around rather than go for the quick loan. However, they could be substantially higher than local banks or credit unions. Typically, Rocket Mortgage interest rates are in line or slightly lower with those at the big banks. Read More: 5 San Diego First Time Home Buyer Programs Reason 4 - Its Rates May Be Higher Than Local Mortgage Lenders. Rocket Mortgage may not list every program you could use to get into a home. There are also many private foundation programs and grant opportunities that target certain demographics for help with housing. There are a number of programs, like the government-backed Federal Housing Administration (FHA) program or a variety of others through HUD, that you can use to enter the housing market. Reason 3 - It May Not List All The Home Lending Programs That Could Qualify You. This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply. This consent applies even if you are on a corporate, state or national Do Not Call list. You also agree to our Terms of Service, and to our Privacy Policy regarding the information relating to you. Some of that scheduling process depends on the seller too.īy proceeding, you consent to receive calls and texts at the number you provided, including marketing by auto-dialer, pre-recorded voicemail, and email, from this site's operators about real estate related matters, but not as a condition of purchase. Even if you are approved for a loan and buy a home, you will still need to wait until a closing date is scheduled to move. Rocket Mortgage doesn't necessary shorten the time it takes for you to move into your new home either. You can move forward and the process continues for you to gain approval. Reason 1 - You Don't Get Qualified for a Mortgage Loan in Eight Minutes.Īfter filling out the applications, the product shows you the types of home loans you could obtain given the information it found. Reason 5 - Rocket Mortgage Doesn't Allow You to Escape From Talking to a Mortgage professional. Reason 4 - Its Rates May Be Higher Than Local Mortgage Lenders. Reason 3 - It May Not List All The Home Lending Programs That Could Qualify You. Reason 2 - You Will Need to Submit Some Information and Documents Beyond the Application. Reason 1 - You Don't Get Qualified for a Mortgage Loan in Eight Minutes. While those looking for a home in San Diego may relish that idea, there are reasons to be cautious about using the Rocket Mortgage product. It boasts of its streamlined process using high-tech to collect information about you quickly into one place, making the mortgage lending process quick, easy and stress free. Part of the Rocket Mortgage brand is a potential homeowner can launch into a home loan application and be approved in eight minutes. VISIT: San Diego’s 10 Most Affordable Neighborhoods in 2023 | 2024 That began with a Superbowl ad in 2015 and continues as the company who owns the product, Quicken Loans, moves forward with its branding. Millions of people have used the program to apply for a mortgage. It brought in $7 billion in closed loans in 2016, its first year in business. Rocket Mortgage is now the largest mortgage lending program in the United States. VISIT: San Diego’s 7 Wealthiest Neighborhoods in 2023 | 2024 A nice man understands your confusion at mortgage lending terms and hands you a smart phone. The television commercials make it look so simple.

0 kommentar(er)

0 kommentar(er)